3D printing of fiber-reinforced polymers is rapidly approaching a commercial tipping point. This is quickly becoming one of the most exciting and impactful areas of 3D printing; over the next decade the market will grow to $2bn, the installed base and applications will expand, and technology will continue to mature.

This growth will not be without challenges; there are barriers to adoption to be overcome in multiple sectors, supply chains & digital infrastructures to be established, and an inevitable consolidation in the number of manufacturers.

The reason for the interest in this sector is easily apparent. 3D printing of polymer materials can have mechanical limitations that benefit from fiber reinforcement (or other functionalities), and composite manufacturing is known to be costly, and challenging this can benefit from the moldless, rapid prototyping, and automated approach that additive manufacturing enables.

In their latest market report ‘3D Printing Composites 2021-2031: Technology and Market Analysis’, IDTechEx provides a comprehensive view of the 3D printing market for composite material including granular 10-year forecasts, material and printer benchmarking studies, application case studies, and interview-based company profiles.

There are numerous approaches to 3D printing composite material, with key considerations around the material (continuous fiber vs chopped fibers; thermoplastic vs thermoset) and the printer properties that make it appropriate for an industrial organization or a desktop device for prosumers or hobbyists. The most mature technology is 3D printing of thermoplastic composites using variations on fused filament fabrication (FFF).

There are numerous emerging technology developments, from those achieving chopped fiber alignments in a photopolymer, high-throughput, multi-axis printers, larger scales, increasing the fiber content, thermoset dispensing, multi-material capabilities, and more. These developments are detailed throughout the market report.

This must also be compared against the incumbent technology and broader developments taking place in the automated manufacturing of composite materials. From AFP & ATL processes through to pick-and-place robots for organosheets, there is much to be aware of to understand the role that 3D printing can play within this industry.

Central to this industry are the materials that are used. These materials are what dictates the part properties and printer requirements; they are also a key part of the competitive business models that are being employed. This market report provides a comprehensive assessment of the material providers and a price and properties benchmarking study. Continuous fiber composites are for many the end goal, with significant value, but there is a large opportunity in their short counterparts and a range of thermoplastics and thermoset resins being deployed.

Numerous strategic partnerships are being established between emerging hardware manufacturers and major chemical companies as well as activity between these chemical companies, the most notable being the acquisition of Owens Corning business line by BASF in 2020. There are also companies directly entering this field launching filaments or other composite material; a prime example is Braskem’s entry into this field with their recycled carbon fiber reinforced PP.

What Are The Latest Developments?

There are countless news stories over the past few years with product launches, partnerships, and new companies. Perhaps the most significant surround the market leaders, Markforged; since late 2020 the company has announced new materials, printers, and distribution partners, they are planning to go public which will release considerable funds to facilitate growth and M&A activity, and are subject of a lawsuit filed by Continuous Composites for patent infringement.

The company has a well-documented complex history with Desktop Metal who launched its first entry into 3D printing composites in late 2019 with its Fiber product.

Most of the activity in this field is centralized in the US, but it is not exclusively there; in ‘3D Printing Composites 2021-2031: Technology and Market Analysis’, IDTechEx tracks the technology and market technology globally with key emerging players emerging across Europe and Asia in an increasingly competitive market.

The classic hardware selling model is not the only one being pursued. Many have developed proprietary technology but instead of selling equipment, they look to use it in-house and act as a service provider, contract manufacturer, or even selling products directly to consumers.

Where Are The Applications?

The permanent question around any new hardware or material coming is finding the industry pain points and the applications where there is a clear value-add. Additive manufacturing is known to have key advantages but is traditionally held back in factors such as production rate, available materials portfolio, training & know-how requirements, scale, and more. In many cases, this has capped the applications to the likes of prototypes and tooling.

The story for composite printers is not overly different. There are increasing examples of end-use parts, which will only continue to increase, but the main area is on the manufacturing floor with jigs, fixtures, tools, and other equipment. This will progress into low to medium part runs, particularly with new solutions emerging and significant interest from high-value sectors such as aerospace and medical, but the manufacturing floor is still a potentially very lucrative area and where there is a clear value-add.

Composite printers can not only allow metal parts to be replaced and facilitate design improvements but give the company the capability to bring this technology in-house, reducing both supplier costs and inventory challenges driven by long lead-times for replacement parts.

What Is The Market Outlook?

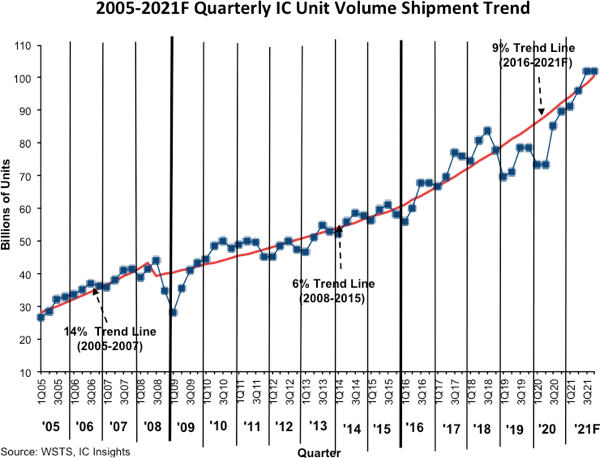

IDTechEx forecast the total revenue for 3D printing composites to reach $2bn by 2031 from much smaller values in 2021. The COVID-19 pandemic has disrupted the industry which has been a minor setback, but printer usage recovered fairly quickly, and it has certainly accelerated the discussion around a robust distributed supply chain which benefits 3D printing.

There is already a reasonable installed base in composite 3D printers, but obviously much smaller than their polymer counterparts and set to grow significantly. Existing polymer printers can often accommodate certain composite material, but typically at very low loading percentages and with several limitations. This market report focuses on those printers designed for FRP materials. This growing installed base will lead to notable revenues in follow-on sales for materials, software and services which will quickly overtake hardware sales.