New research out of Florida State University explains the math behind how initial predispositions and additional information affect decision-making.

The team’s findings indicate that when decision-makers quickly reach a conclusion, it is more influenced by initial bias or a tendency to err on the side of one of the choices presented. If decision-makers wait to gather more information, a slower decision will be less biased. The work was published today in Physical Review E.

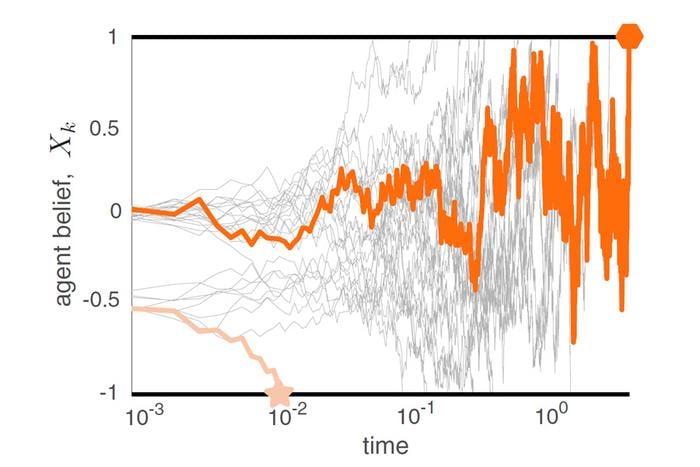

“The basic result might seem sort of intuitive, but the mathematics we had to employ to prove this was really non-trivial,” said Bhargav Karamched, an assistant professor in the FSU Department of Mathematics and the Institute of Molecular Biophysics. “We saw that for the first decider in a group, the trajectory of their belief is almost a straight line. The last decider hovers around, going back and forth for a while before making a decision. Even though the underlying equation for each agent’s belief is the same except for their initial bias, the statistics and behavior of each individual is very different.”

CREDIT: Courtesy of Bhargav Karamched

Researchers built a mathematical model representing a group of agents necessary to decide between two conclusions, one correct and one incorrect. The model assumed each actor within a group was acting rationally, deciding based on their initial bias and the information they are presented, rather than being influenced by the decisions of those around them.

Surprisingly, bias toward a particular decision caused the earliest deciders in the model to make the wrong conclusion 50% of the time. The more information they gathered, the more likely they were to behave as if they weren’t biased and to arrive at a correct conclusion.

In real time, people are swayed by a variety of inputs, including emotions, the decisions their friends made, and other variables.

The research model used is a drift diffusion model, combining two concepts: the individual actor’s tendency to “drift,” or move toward an outcome based on evidence and the random “diffusion,” or variability of the information presented.

This research was supported by the National Science Foundation and the National Institutes of Health.