ROHM Semiconductor today announced its new BP35C5 Wi-SUN FAN (Field Area Network) compatible module solution capable of connecting with up to 1000 nodes in mesh networks for infrastructure applications. Wi-SUN FAN, the latest Wi-SUN international wireless communication standard, eliminates the communication costs associated with conventional LPWA. At the same time, Wi-SUN ensures superior reliability through multi-hop networks that automatically switch destinations after performing signal verification. As such, this communication technology is expected to see widespread use in large-scale mesh networks for smart cities and smart grids.

In recent years, wireless technologies such as LPWA have been increasingly adopted in social infrastructure applications to configure large-scale area outdoor networks. However, conventional LPWA protocols (e.g., Sigfox, LoRaWAN, NB-IoT) are vulnerable to changes in the surrounding environment (i.e., new building creation), making them susceptible to problems that include decreased communication speeds, as well as communication failures.

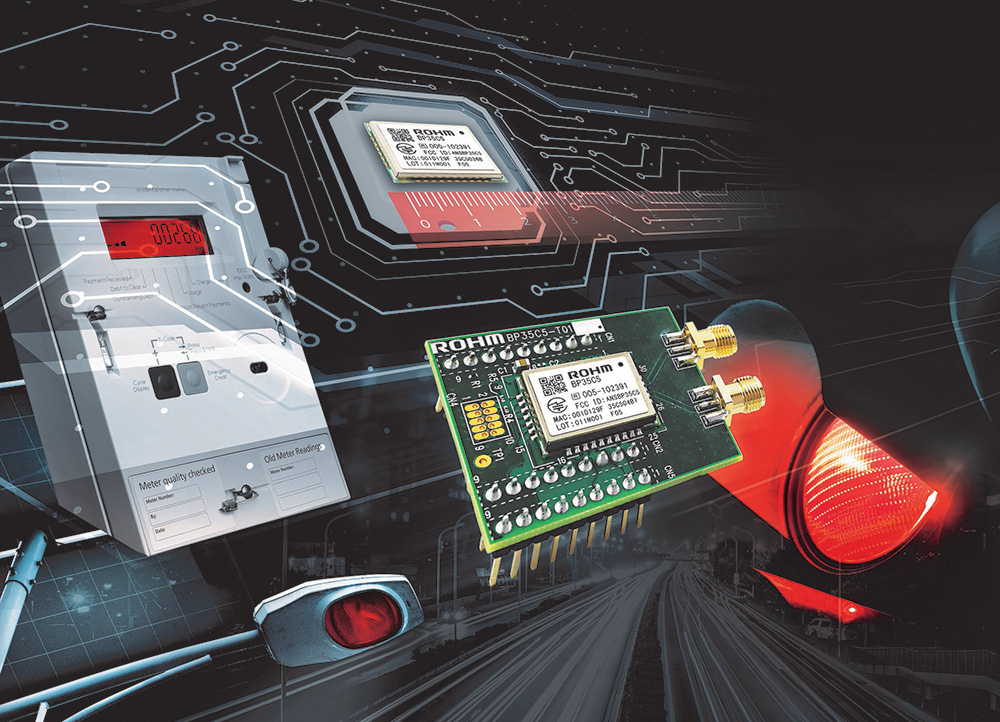

In response, ROHM’s new Wi-SUN FAN solution utilizes an in-house developed ultra-small (15.0mm × 19.0mm) BP35C5 Wi-SUN FAN compatible wireless communication module. This solution is capable of connecting with up to 1,000 devices (e.g., traffic signals and streetlights), enabling the configuration of a remote wireless management system covering an entire city. The BP35C5 also includes the necessary security functions for carrying out secure communication, without the need for complicated control. Certifications acquired under the FCC (Federal Communications Commission) and ARIB (Association of Radio Industries and Business) allow for immediate use both in the U.S. and Japan. Other countries and regions will be supported in the near future.

The BP35C5 solution evaluation board (BP35C5-T01) is available for purchase now through online distributors Digi-Key and Mouser.

What is Wi-SUN FAN?

Wi-SUN FAN (Wireless Smart Utility Network for Field Area Network profile), the latest protocol under the Wi-SUN international communication standard with over 95 million units shipped worldwide, is expected to see broad adoption as a network technology for achieving an IoT society by providing superior reliability in a variety of systems used to construct smart cities and smart grids, including infrastructure and advanced transportation systems as well as electricity, gas, and water meters.

Whereas conventional LPWA standards support only star-type networks, Wi-SUN FAN enables the configuration of mesh networks capable of performing multi-hop transmission between relays while allowing for remote management of terminal-mounted applications via bidirectional communication between relays and terminals. This makes it possible to automatically optimize the hop route between relays – even in the event of communication failure due to newly constructed buildings or other surrounding obstacles – ensuring stable communication with higher reliability than other communication standards. Unlike other LPWA standards that incur communication costs for each terminal, Wi-SUN FAN can be operated at little to no cost.