Automotive Diagnostic Scan Tools Market to Reach $49bn by 2025

The revenue of Automotive Diagnostic Scan Tools Market crossed $33bn in the year 2018 and is predicted to touch 49 billion-dollar mark till 2025, growing at five percent between the years 2019 and 2025; as per the research done by Global Market Insights.

The automotive diagnostic scan tools market growth is attributed to the stringent vehicle emission norms introduced by governments all over the globe. The increasing sales of vehicles will lead to continuous repair & maintenance activities to keep track of vehicle health and engine emissions, resulting in the growth of the automotive diagnostic scan tools market.

With the advent of advanced technologies, such as AI, AR, and VR, the vehicles are offering advanced features, such as ABS, ADAS, and cruise control, increasing the number of ECUs in the vehicles. This complexity in vehicles has increased the time required for the detection of faults through manual diagnosis and requires automotive diagnostic scan tools to detect faults to increase operational efficiency.

The automakers and OEMs are investing heftily in R&D and adopting advanced technologies, such as AR and VR, to develop innovative diagnostic scan tools. For instance, in September 2016, Bosch automotive service solutions developed BEA 750, which uses augmented reality to increase the operational efficiency of workshops and service stations.

The automotive diagnostic scan tools market is growing at a significant CAGR over the forecast period due to the growing demand for autonomous vehicles around the globe. For instance, in 2017, autonomous car sales were estimated to be 24.23 million units and are anticipated to reach 61.82 million units by 2024, growing at a CAGR of 14.4% between 2018 and 2024.

Automotive diagnostic scan tools market.

The automotive diagnostic scan tools software market is projected to grow substantially over the forecast timeline due to declining air quality index and increasing vehicle production & sales across the globe. The automotive diagnostic scan tool has evolved over the years due to the amendments in environmental regulations. The US Environmental Protection Agency (EPA) has primarily influenced the introduction of OBD-I and OBD-II.

The automotive diagnostic scan tool manufacturers are strategically manufacturing diagnostic scan tools, which are compatible with almost every vehicle ranging from 15 years old to new model vehicles. These manufacturers are anticipated to compete against the diagnostic scan tools manufactured by automakers, providing a competitive advantage due to the compatibility of the tools.

The diagnostic scanners segment held a dominant share in 2018 and will maintain the automotive diagnostic scan tools market share over the forecast timeline. Automakers and technicians use automotive diagnostic scanners to gain access to vehicle-related data to identify any malfunction in the engine or sub-components. OBD scanners, particularly code readers and scan tools provide access to information about manufacturer-specific codes, customizable access to recorded data, and offer advanced troubleshooting information.

The increasing vehicle sales between 2015 to 2018 have increased the demand for diagnostic services. Increasing internet penetration, technological development, such as IoT, and the proliferation of smartphones are helping users to diagnose their vehicles at a customer-specific and cost-effective service center. Technical consultations and the adoption of customization in vehicles are driving the growth of the automotive diagnostic scan tools market.

Vehicle tracking keeps track of vehicles, people, and assets in real-time as well as records the activity history including departure, arrival, and stoppage duration. Vehicle tracking information is stored on cloud platforms that can easily be accessed through mobile applications. The pertinent tracking information can also be retrieved by connecting devices to a USB port. This helps service centers to reach the vehicle breakdown spot and repair the faulty vehicle. Stringent government regulation related to passenger & vehicle safety is driving the demand for integrated vehicle tracking in new vehicles.

OEM automotive diagnostic scan tools market is estimated to register substantial growth rate over the forecast timeline due to growing trend of forward integration among the automakers. Additionally, the automakers and OEMs are partnering with technology-based companies to offer a wide range of automotive diagnostic scan tools. For instance, in October 2018, BMW Group partnered with KPIT and TTTech as software partners with a global footprint and proven expertise in the development of both software platforms, diagnostic scan tools, and autonomous driving technologies.

North America automotive diagnostic scan tools market holds a significant share in the global industry due to the presence of prominent OEMs in this region. In addition, stringent government norms related to vehicle emission in the region are also affecting the market. There is a significant increase in activity and speculation related to tariffs and duties between the U.S. and its trading partners including China and the EU. The advent of self-driving cars, EVs, and HEVs will positively impact market growth.

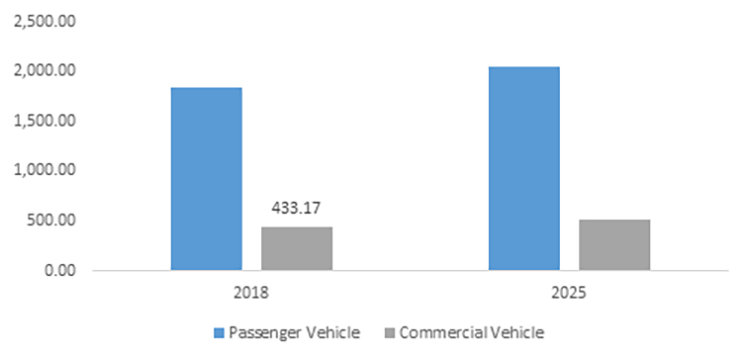

Russia Automotive Diagnostic Scan Tools Market Revenue, By Vehicle Type, 2018 & 2025.

The prominent automakers and OEMs across the globe are entering into strategic alliances, such as acquisitions, mergers, and partnerships, with other market players. For instance, in October 2018, Magneti Marelli, an automotive component business of Fiat Chrysler Automotive N.V., was acquired by CK, a holding company of Calsonic Kansei Corporation, for $7.31bn.

Additionally, the automakers are investing extensively in automotive diagnostic scan tools to develop innovative diagnostic scan tools solutions.

The major players operating in the automotive diagnostic scan tools market are Hickok Incorporated, Honda Motor Company, BMW, Actia Group, Fluke Corporation, Autel Intelligent Technology, Launch Tech UK, Bosch Automotive Service Solutions, Denso Corporation, DG Technologies, Daimler, Delphi Automotive, Volkswagen, Snap-on Incorporated, AVL List, General Technologies, Continental, KPIT Technologies, Softing and Volvo Group.