Molex ‘Data Center on Wheels’ Global Automotive Survey Released

Molex just released the results of a global survey that looks at the pace of innovation accelerating the development of next-gen vehicle architectures and driving experiences. The survey addresses today’s demands for vehicles equipped with software, storage, connectivity, and computing capabilities—a powerful “data center on wheels.”

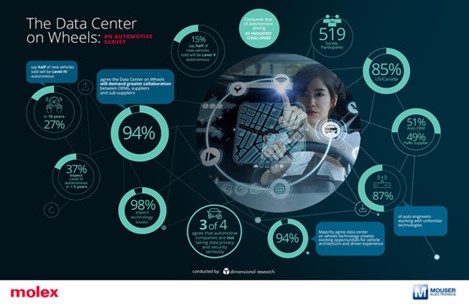

Dimensional Research conducted The Data Center on Wheels automotive survey in February 2022, polling 519 qualified participants in engineering, R&D, manufacturing, innovation, or strategy roles at automotive companies and their suppliers, including Tier 1 or 2 auto-parts suppliers and contract manufacturers. The participants answered questions to determine digital technologies making the most significant impacts and the most challenging obstacles impeding the deployment of advanced vehicle architectures and seamless driving experiences.

Results include:

- 94% agree digital technologies create exciting opportunities but will require greater cooperation among stakeholders

- In less than five years, digital technologies will empower such standard new vehicle features as user interfaces via mobile app (50%), streaming movies and TV (47%), remote enablement of new/add-on features (46%), subscription-model pricing for key features (46%), safety and driver assistance (45%), along with over-the-air software updates (43%)

- 27% believe that half of new vehicles sold within ten years will support Level IV autonomous, while 18% believe it will take up to 30 years for Level V to reach that milestone

- 45% say in-car connectivity has had the most impact on vehicle architectures and driving experiences over the past five years, followed by data storage systems (43%) and cloud computing (43%)

- In the next five years, immersive UX/UI (39%) and out-of-car connectivity (32%), encompassing 5G and vehicle-to-everything (V2X) communications will deliver the most significant gains

- Obstacles cited include cybersecurity (54%), software quality (41%), functional safety (36%), connecting vehicles to the cloud (29%) as well as data storage and analysis (28%).

- More than two-thirds believe software will cause more technical issues than hardware, while over 50% say new services across the software ecosystem are needed, spanning operating systems, AI models, functional safety information, and more.

Respondents ranked critical industry issues that could slow adoption, such as consumer fear of autonomous driving (43%), insufficient investments outside vehicles in terms of charging stations and 5G antennas (37%), limited understanding of the potential among auto company leadership (36%) and data privacy (34%). Supply chain shortages also are expected to impact delivery of next-gen vehicles, led by battery availability and chemistry (47%), semiconductor chips (45%), sensors (42%), connector cables, and assemblies (40%), and connectors (38%).