Consumer enthusiasm for connectivity to propel tech industry

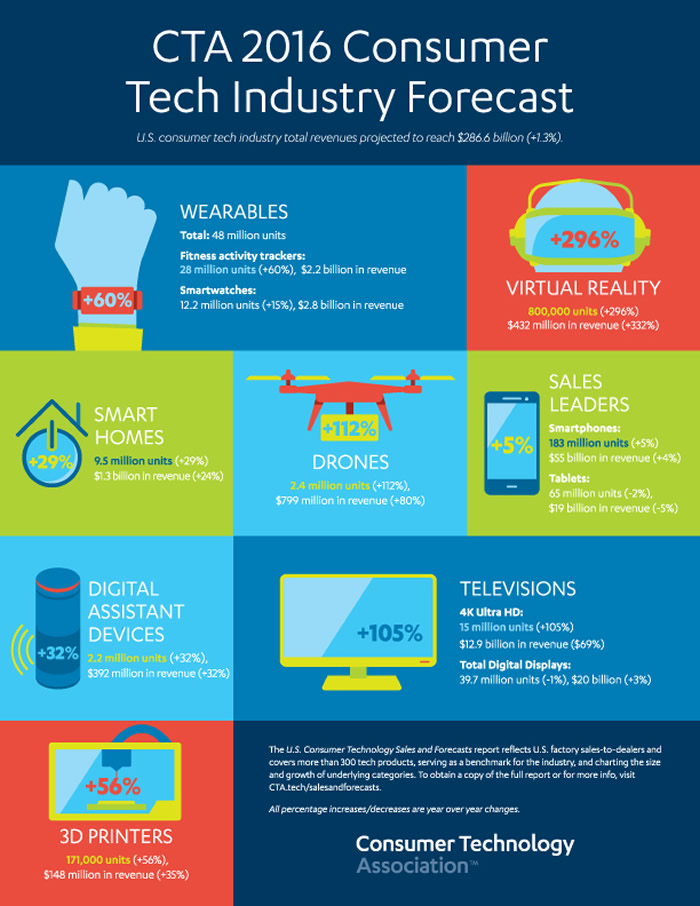

According to new research from the Consumer Technology Association (CTA), increasing consumer enthusiasm for the Internet of Things (IoT) and adoption of emerging technology will drive the U.S. consumer technology industry to $292bn in retail revenues ($228bn wholesale) in 2017. The latest edition of CTA’s semi-annual industry report, U.S. Consumer Technology Sales and Forecasts – unveiled today in advance of CES 2017 – says sales of emerging tech products such as smart home devices, wearables and 4K Ultra HD televisions will help produce 1.5% year-over-year (YOY) growth in industry revenues.

“Our forecast reinforces our belief that connectivity is going to be one of the driving trends of our time,” said Gary Shapiro, President and CEO, CTA. “More and more consumers are discovering the remarkable benefits connected products deliver, providing anytime/anywhere access to information, entertainment and each other. Consumers recognize that connected innovations are changing our lives for the better – offering us more control and personalization while helping us lead safer, healthier and happier lives.”

As the nation’s largest tech trade association, CTA’s semi-annual report serves as a benchmark for the consumer technology industry, charting the size and growth of underlying product categories. The CTA consensus forecast reflects U.S. factory sales-to-dealers for more than 300 consumer tech products.

Emerging technology categories

Among categories tracked by CTA’s forecasts, U.S. sales of connected devices are projected to reach 600 million units in 2017 – a record high total and 5% YOY increase from 2016.

- Smart home: This is evolving as consumers’ most popular means of IoT engagement. CTA projects the smart home category – including smart thermostats, smart smoke and CO detectors, IP/Wi-Fi cameras, smart locks and doorbells, smart home systems, and smart switches, dimmers and outlets – to reach sales of 29 million units in 2017 (63% increase over 2016), earning $3.5bn (57% increase).

- Digital assistant devices: These products present an opportunity to understand how home tech products will integrate artificial intelligence over time. 2017 unit sales projections for voice-controlled, stand-alone digital assistant devices with a cloud-based operating system – including Amazon’s Echo and Google Home – are expected to reach 4.5 million units (52% increase) and reach $608m in revenue (36% increase).

- 4K Ultra High-Definition (4K UHD): 4K UHD TVs are one of the industry’s fastest growing segments, driven in part by next-generation technologies such as high dynamic range and wide color gamut. Growth of the 4K UHD market significantly outpaces the transition to high-definition television, with just three years since introduction; cumulative sales of 4K UHD displays are forecast to hit 18.6 million units, while sales of HDTVs reached 4.2 million units in their first three years on the market. CTA projects shipments of 4K UHD displays to reach 15.6 million units in 2017 (51% increase) and earn $14.6bn in revenue (38% increase).

- Virtual Reality (VR) and Augmented Reality (AR): Among the tech sector’s overwhelming leaders in YOY growth in 2017, VR headset unit sales are projected to reach 2.5 million units (79% increase) and $660m in revenues (43% increase). CTA’s AR/VR Working Group recently finalized a set of industry definitions to better explain the spectrum of experiences in this category.

- Drones: Total drone sales are expected to reach new heights in 2017, topping 3.4 million units (40% increase) and $1bn in revenue for the first time (46 % increase). CTA’s forecast also delineates U.S. drone sales for units below and above 250 grams, the FAA’s division for mandatory drone registration: Drones below 250 grams are expected to reach 2 million units, and drones above 250 grams will sell 1.3 million units.

- Wearables: Again driven by the popularity of fitness activity trackers, the total wearables market in 2017 – including other health and fitness devices, hearables and smartwatches – is expected to reach 48 million unit sales (14% increase) and earn $5.5bn in revenue (3% increase).

“2016 was an important year of transition – with potentially game changing products including VR headsets and digital assistant devices gaining steam within mass consumer markets. I expect 2017 to be a year where many of these emerging tech categories find their footing and really take off,” said Shawn DuBravac, Ph.D., chief economist, CTA.

“We’ve had more progress in voice-activated digital assistants in the last 30 months than in the first 30 years. Word recognition accuracy has improved from nearly zero percent in the 1990s to 75% in 2013 to about 95% today – enabling these devices to enjoy immense consumer adoption. While still in a period of massive experimentation, we’re increasingly moving away from what is technologically possible and focusing on what is technologically meaningful.”

In addition to devices, automotive is another hotbed of innovation. Factory-installed technologies, from entertainment systems to driver-assist features, make up an estimated 50% of the collective value in new vehicles, up from about 25% just 10 years ago. CTA estimates factory-installed automotive technologies will contribute nearly $17bn to industry sales in 2017.

Maturing technology categories

The five largest revenue drivers will contribute almost half of total industry revenue (48%) in 2017. Despite revenue declines across some of the largest categories, unit shipment increases demonstrate continued resilience in these categories.

- Smartphones: Unit volume will grow 3% to reach 185 million smartphones sold in 2017, with revenues expected to reach $55.6bn (2% increase). Unit volume will taper off by 2020, as hardware better meets the average user’s computing demands and replacement cycles lengthen.

- Televisions: While LCD television unit shipments enjoyed their best year yet in 2016, 2017 will initiate a period of slight declines with unit volume at 39 million units (2% decrease) and $17.8bn in revenue (2% decrease). Future category growth will be driven by 4K UHD upgrades, as outlined above.

- Tablets: While tablets remain one of the best performing categories in terms of total volume, after momentous adoption of tablets over the past five years, near-term adoption has leveled off and replacement cycles have slowed. Tablet sales will decline in 2017, as CTA expects sales of 59 million units (5% decrease) and revenues of $16bn (8% decrease).

- Laptops: In 2017, the laptop market will sell 27 million units, holding steady with last year, and earn $15.6bn in revenue (3% decrease). Growth within the laptop market will come from convertible models in the coming years.

- Desktops: The desktop market will continue to see structural declines, with projected unit sales of 6.7 million (7%decrease) and revenue of $3.9bn (8% decrease).

“Continued revenue growth in the U.S. consumer technology sector is critical to overall U.S. economic growth,” noted Shapiro. “Our sector supports more than 15 million jobs across the nation, directly, indirectly and induced, and accounts for more than 10 percent of total U.S. GDP, per a recent CTA economic study.”

CTA publishes the U.S. Consumer Technology Sales and Forecasts twice a year, in January and July, reporting U.S. factory sales-to-dealers. It was designed and formulated by CTA, the most comprehensive source of sales data, forecasts, consumer research and historical trends for the consumer technology industry. Multi-year projections cannot account for unpredictable factors such as changes in trade laws, interest rates and federal policy.

Comments are closed, but trackbacks and pingbacks are open.